New Nevermined component allows marketplaces to offer NFT-backed loans

Access Credits

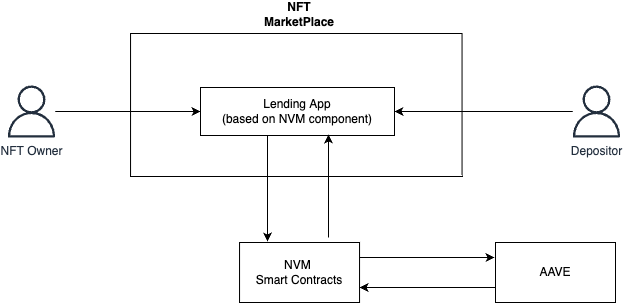

4 min readWe are excited to announce a new Nevermined feature that can take NFT marketplaces to the next level. We’ve integrated the Aave liquidity protocol into our development platform, which means that marketplaces can start offering a new service to their collectors, as well as attract a new breed of users: loan providers.

The benefits of this new component are double. It makes it possible for NFT collectors to create loan agreements using their NFTs as collateral, without having to leave their trusted marketplace. The benefit for depositors is that they can receive two streams of return: from the collector and from an Aave vault.

So, what problems does this fix?

- We know it’s difficult for NFT owners to use their assets as collateral for loans. Collectors need to sign up to new lending platforms, re-build that trust relationship and assume that these new dapps have enough liquidity to borrow from.

- On the other hand, it’s equally difficult for loan providers to get exposure to the capital that is locked in NFTs. And even so, the volatility of the NFT space makes it a risky move.

- And finally, for marketplaces to offer a service like this directly on their platform, means they would have to build an integration with Aave from scratch. This takes considerable time.

The Nevermined NFT-Backed Loan Component fixes all this. It can be integrated into any platform that wants to offer a completely on-chain method for NFT collateralized loans, using Aave as a protocol for deposits.

Capital efficiency

To build this Polygon integration with the Aave protocol, our component uses their Credit Delegation functionality, which allows for a more efficient use of capital. Let’s introduce Alice and Bob. Alice is an NFT collector who wants to use her assets as collateral for a loan. Bob is a Depositor, which means he has capital available to lend.

Rather than put his money in an Aave vault or make it available on an NFT lending platform, Bob can go to an NFT marketplace that runs our Nevermined component and do both. By making a deposit, our integration with the Aave’s Credit Delegation will give Bob a yield from an Aave vault as well as earn interest from an over-collaterized loan he’s providing to Alice.

What our component does — invisibly — is expose Bob to Alice. Simply put, we provide the plumbing to connect an existing NFT marketplace with Aave and allow Alice and Bob to create a peer-to-peer agreement, on a marketplace they know and trust.

All this is packaged in an SDK, which makes it easy for the dev teams of marketplaces to integrate it into their stack.

Under the hood

The concept of our component is as follows:

- it creates an Aave vault as well as a loan offering (overcollateralized)

- it creates an agreement between Alice and Bob

- it arranges the transfer and the holding of the NFT

- it gives Alice access to Bob’s funds via Aave

- it arranges the settlement of the loan at the expiry date.

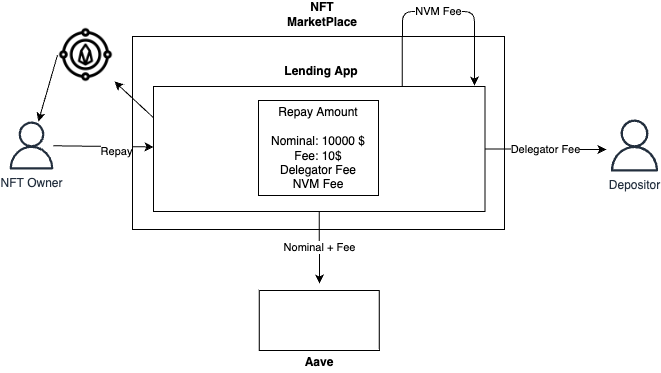

A more detailed flow can be described as follows.

Alice is an NFT collector and sees that her favorite NFT platform has integrated the Nevermined component and is now offering a new feature: NFT-backed loans.

She uses the UI of her regular marketplace, but under the hood, the Nevermined component creates a new agreement with Bob. Bob is looking for a return on his capital and has used the marketplace to make his money available for NFT-backed loans. When the agreement is created, a transaction is sent to the smart contracts as agreement settlement.

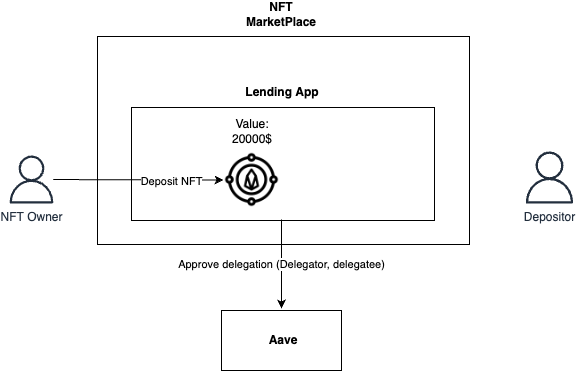

Next, Alice deposits the NFT. This gets registered on the Nevermined platform, the NFT gets locked and the smart contract then calls Aave on behalf of Bob to approve a credit line.

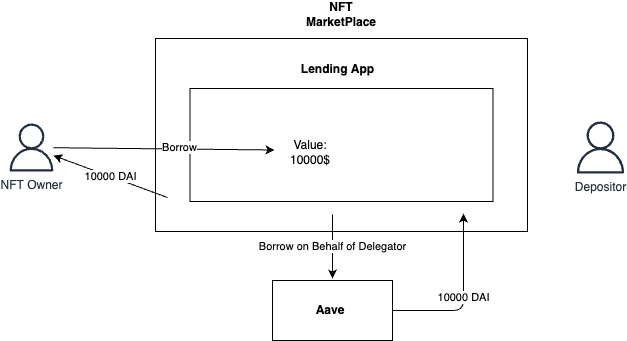

At this point the credit line is open and Alice can borrow money from Aave, using Nevermined as proxy on behalf of Bob.

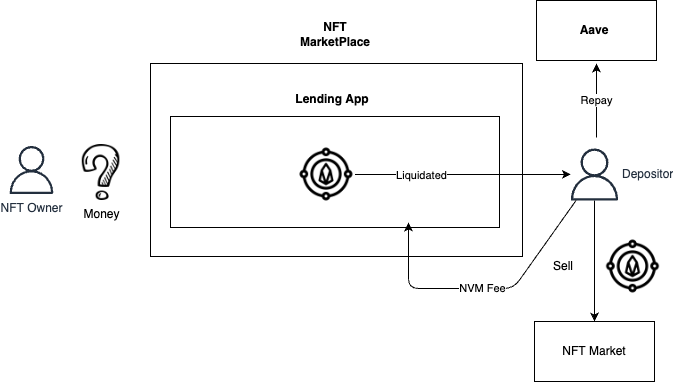

If Alice doesn’t repay the loan when the loan gets to the maturity date, the NFT is automatically transferred to Bob, who can sell this and settle the loan.

If Alice uses the loan to work her degen magic, she should have more money than at the start of the loan. She can repay the loan, plus fees and the NFT is returned to her.

Learn More

Note that Nevermined is a protocol that is use-case agnostic, thanks to its modular architecture. We don’t build marketplaces ourselves. We provide components to give users and marketplaces more advanced features and a better Web3 experience.

If you are interested in seeing how this project is working, we have a demo version deployed in the Polygon Mumbai testnet. To get an idea how this frontend works, we have published two videos. The first one shows how the normal flow works, where the borrower can totally repay the payment. In the second one you can see how the process works if the loan is not repaid and is liquidated.

If you are a developer and want to learn more about this project, we have the use case flow documented in our repository and you can check the new service implementation in our contracts. Nevermined also provides an SDK to allow developers to use this implementation directly using Javascript, which can be found here.

If you have any questions or something to share about this project, you can always contact us in our Discord.

Originally posted on 2022-08-11 on Medium.